Types of finance available

Two ways to find finance

1 | Search Finance

A smart directory of banks, non-bank lenders and brokers globally. Connect with finance providers directly.

The fastest way for borrowers to search for finance.

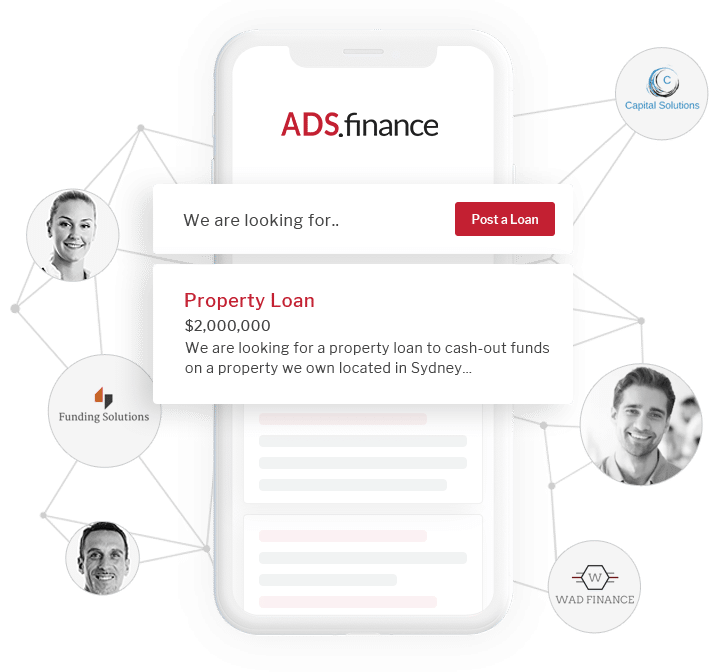

2 | Post a Loan

Post a loan and have interested lenders and brokers message you directly.

Massive distribution across multiple finance providers.

Things you might want to know

People looking for a loan or a private loan can interact with our platform in one of two ways:

- Search Finance: is an online directory of finance providers you can use to search for financing options. This is really just a search engine for finance – which can be viewed by loan amounts, loan types and geography.

- Post a Loan: simply post a loan scenario to the platform and have only those interested finance providers contact you who are interested. You do not need to waste time reaching out to multiple lenders or brokers who may not have solutions for your situation. Let the market tell you how they can help.

- Home loans

- Construction loans

- Business loans

- Bridging finance

- Site Acquisition

- Second mortgage

- Land subdivision

- Investment loans

- Residual stock

- Refinance

- Personal loans

- Cash flow lends

- Asset backed loans

- Receivables finance

- Existing properties

- Development finance

- Private funding

- Home lending

We also rely on feedback from users in order to determine whether a lender or broker should be removed from the platform based on their conduct. We have a User Agreement which must be complied with by all Users to remain on the platform.

You can utilise your ADS account to:

Generate more business

- Allow you to view loan scenarios posted by brokers/borrowers and contact them directly to settle deals.

- Expand your business network by meeting new broker and borrower contacts.

- Overall access to more deal flow.

Advertise your business

- Advertise your loan products and capabilities on our site to borrowers and brokers interested in lending products.

- Update your lender profile, upload your product sheet and post your updates to the broker and borrower community.

Join our ADS network as a lender or broker and grow your business